Do you ever get off the phone from your accountant or HMRC more confused than when you started? Have no fear Valued are here!

We’ve broken down some of the most commonly used accounting terms along with their acronyms so why not save this blog and use it as a reference for in the future.

Accounts Payable (AP)

Accounts Payable are also known as trader creditors. These are invoices/costs that have been incurred before the period end date but not physically paid until after the period end date.

For example a cafe orders ingredients for their business on the 15th March but does not pay for the invoice until the 15th April. As of 31st March period end date the invoice for the ingredients would be an accounts payable.

Accounts Receivable (AR)

Accounts Receivable are also known as trade debtors. These are invoices raised for work done before the period end date but not physically paid until after the period end date.

For example, a manufacturer produces a product and delivers it to the customer on the 15th March but does not receive payment until the 15th April. As of 31st March period end date the invoice would be an accounts receivable.

Accrued Expense

An expense that has been billed at a later date than when it was consumed.

For example, Water rates are billed quarterly at £150, the last invoice received was in March for Jan-March quarter.

The cost would be accrued in Jan and Feb at £50 then reversed in March resulting in an even spread of cost £50

Example of above without using accrued expenses

| Jan | Feb | Mar |

| - | - | £150 |

Example of above with the use of accrued expenses

| Jan | Feb | Mar |

| £50 | £50 | £50 |

Asset (A)

This is an item which the business owns which is usually measured as a monetary amount held on the balance sheet. Normally this is tangible (you can hold it) but can sometimes be intangible (goodwil).

Some examples of this are cash, stock, property, motor vehicles, equipment.

Liability (L)

Liability is an item which the business owes out, usually measured in monetary value.

Some examples of this are; trade creditors, loans, directors loans, taxes, overdrafts.

Balance Sheet (BS)

A balance sheet is a statement which shows the cumulative movement of profit over time. It includes everything the business owns (assets), everything the business owes out (liabilities), and the profits and share capital which is distributable to the owners.

Net Book Value (NBV)

Net Book Value is the fair value the business would receive if they were to sell that asset at a specific point in time. Some assets, mainly tangible assets like equipment are revalued each year using the method of depreciation or fair value adjustment to achieve the NBV.

Depreciation (Dep)

Depreciation is an accounting adjustment which reduces an assets Net Book Value to illustrate that the asset is not worth today what it was when it was first purchased.

There is normally a policy set on this.

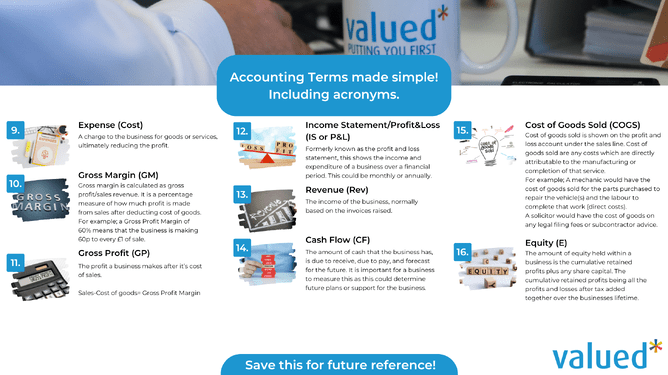

Equity (E)

The amount of equity held within a business is the cumulative retained profits plus any share capital. The cumulative retained profits being all the profits and losses after tax added together over the business' lifetime.

Cost of Goods Sold (COGS)

Cost of goods sold is shown on the profit and loss account under the sales line. Cost of goods sold are any costs which are directly attributable to the manufacturing or completion of that service.

For example; A mechanic would have the cost of goods sold for the parts purchased to repair the vehicle(s) and the labour to complete that work (direct costs).

A solicitor would have the cost of goods on any legal filing fees or subcontractor advice.

Expense (Cost)

A charge to the business for goods or services, ultimately reducing the profit.

Gross Margin (GM)

Gross margin is calculated as gross profit/sales revenue. It is a percentage measure of how much profit is made from sales after deducting cost of goods.

For example; a Gross Profit Margin of 60% means that the business is making 60p to every £1 of sale.

Gross Profit (GP)

The profit a business makes after it’s cost of sales.

Income Statement/Profit & Loss (IS or P&L)

Formerly known as the profit and loss statement, this shows the income and expenditure of a business over a financial period. This could be monthly or annually.

Revenue (Sales/Rev)

The income of the business, normally based on the invoices raised.

Cash Flow (CF)

The amount of cash that the business has, is due to receive, due to pay, and forecast for the future. It is important for a business to measure this as this could determine future plans or support for the business. Read our blog on how to set a budget to find out more and get your free dowloadable budget tool.

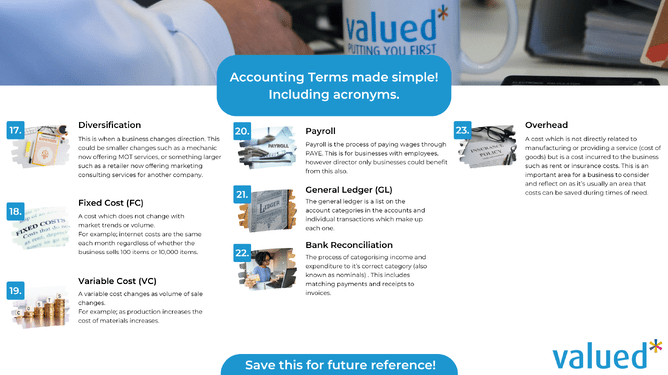

Diversification

This is when a business changes direction. This could be smaller changes such as a mechanic now offering MOT services, or something larger such as a retailer now offering marketing consulting services for another company.

Fixed Cost (FC)

A cost which does not change with market trends or volume.

For example; internet costs are the same each month regardless of whether the business sells 100 items or 10,000 items.

Variable Cost (VC)

A variable cost changes as volume of sale changes.

For example; as production increases the cost of materials increases.

Payroll

Payroll is the process of paying wages through PAYE. This is for businesses with employees, however director only businesses could benefit from this also.

General Ledger (GL)

The general ledger is a list of nominals/account categories which make up the accounts. The individual transactions are then listed under each nominal.

Bank Reconciliation

The process of categorising income and expenditure to it’s correct category (also known as nominals) . This includes matching payments and receipts to invoices.

Xero and Dext work in tandem together to help make this process streamlined. Sign up to our free webinars to find out how they could help you.

Overhead

A cost which is not directly related to manufacturing or providing a service (cost of goods) but is a cost incurred to the business such as rent or insurance costs. This is an important area for a business to consider and reflect on as it’s usually an area that costs can be saved during times of need.

And there you have it. Don't forget to save this blog and the images within it so you have a point of reference that you can refer back to if needed.

If you'd like any other terms explaining or want to know more join us on social media for #taxtuesday where our accountants will answer all of your burning questions.